- Opening in the first year

- Your business commenced in November 2024 for the year of assessment 2024/25 (1 April 2024 – 31 March 2025).

- If the first year-end date falls after 31 March 2025 (e.g. 31 December 2025), there is normally no tax for 2024/25 (as the depreciation allowance may offset the profits).

- The Inland Revenue Department issues tax returns

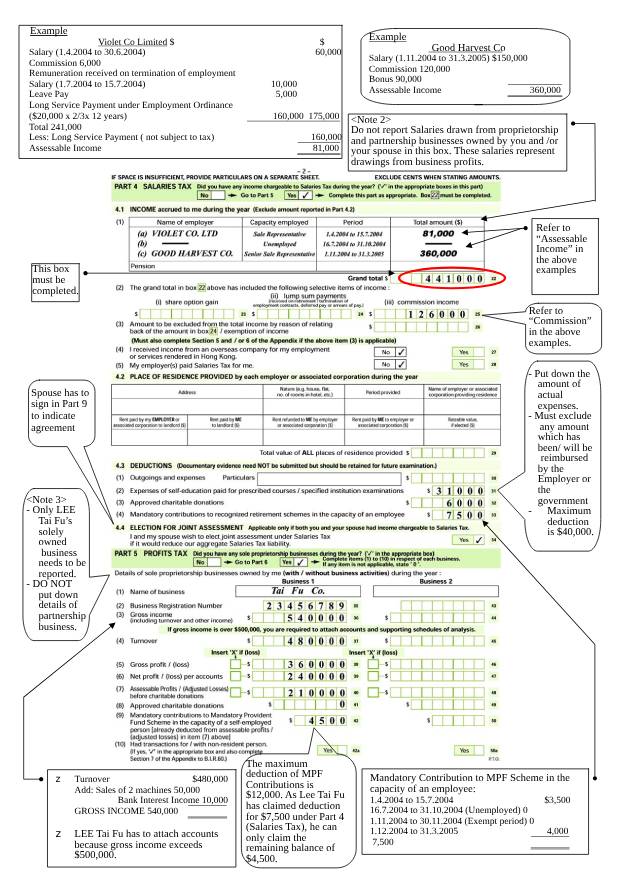

- If you receive BIR60 tax return every year, report the profit/loss of your business directly in the return.

- If you do not receive your tax return every year: The Inland Revenue Department (IRD) may issue the first BIR60 within 18 months after you commence business (around May 2026).

- Cases that require proactive notification

- If there are assessable profits for 2024/25 (after deducting depreciation allowances), the Inland Revenue Department (IRD) must notify the Inland Revenue Department in writing before 31 July 2025 for the issuance of a tax return.

- Failure to notify on time may result in fines.

Filing steps

- Preparation of accounts

- Record all business income, expenses, and draw up a year-end date for the first year (we are advised to do so).

- Maintain receipts and financial records for at least 7 years.

- Complete BIR60 tax return

- Fill in the profit/loss in the sole proprietorship section (calculate the assessable profits according to the IRD guidelines).

- Attach financial statements such as profit and loss statement, balance sheet, etc. (as required by the tax office).

- Submission Deadline

- Once the tax return is received, it needs to be filed within 1 month (e-filing can be extended to 3 months).

Precautions

- High tax allowance in the first year: New business may not need to pay tax in the first year due to tax exemptions such as equipment depreciation, but it still needs to be declared.

- Provisional tax payment mechanism: If there is tax payable, the tax bureau will collect the provisional tax for the next year in advance based on the profit of the current year.

- Late Penalty: Failure to file or notify on time is subject to a penalty of up to $10,000 plus a penalty of 3 times the amount of tax owed.

Inland Revenue https://www.ird.gov.hk/chi/tax/ind_ctr.htm